If your home has plenty of room for storage, it’s likely filled to the brim with old furniture, books, and other stuff that you’ve owned over the years. Most people think that these things are nothing more than clutter, and they should get rid of it soon. However, you may find something that could potentially be worth a fortune in that pile of junk—valuable collectibles.

Collectibles are objects that are prized more than their original selling price. These items are also considered alternative investments since they don’t fit into traditional investment vehicles like stocks, cash, real estate, and bonds. There’s a wide range of collector’s items with high valuations like old coins, antique firearms, paintings made by famous painters, and authentic autographs of notable people.

Old Things That Became Relevant Again

Collectible items are anything that has a higher value compared to their initial price. Their value also increases over time. Although they’re pretty hard to find, some brands develop products intended to become collectibles and mass-produce them. The most famous example of a widely available collectible was the Beanie Babies.

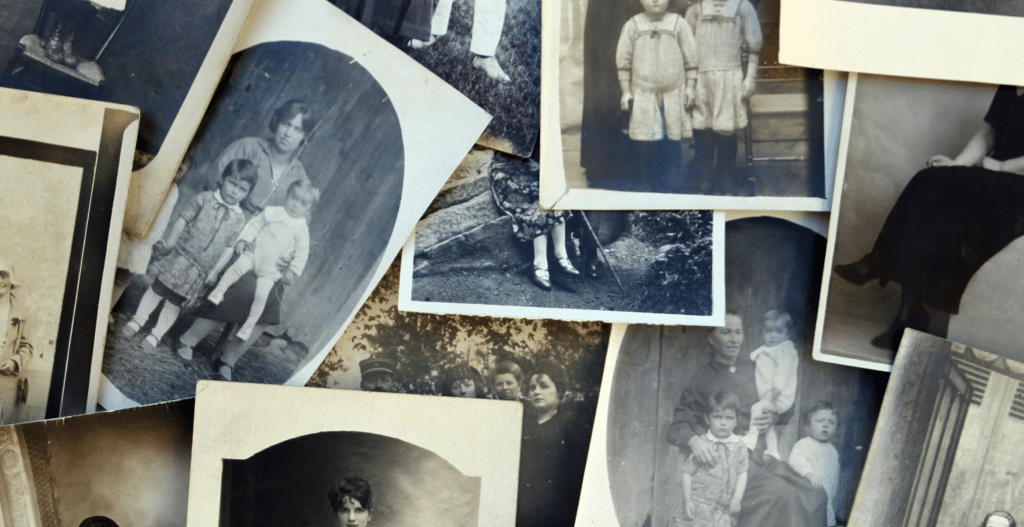

Also, most items in this category attract a collector’s attention, such as vintage photographs or paintings. So, if you want to get the most money out of a collectible, you must ensure that it’s as close to mint condition as possible.

Finding A Collectible’s Value

Most people don’t give second thoughts when people label stamps, comic books, trading cards, coins, and toys as collectibles. But when you talk about precious metals and stones, people usually call them investments instead of memorabilia. These materials, and even stocks, can be labeled as the latter since their price increases with how much people are willing to shell out to purchase them instead of their actual value.

For most metals, their value is based on their scarcity. Even if you melt it or burn it, you’ll still have the same metal by the end of the process. On the other hand, a stock’s value is dependent on the actual company that generates earnings. This makes the price you pay for the stock worth it.

However, collectibles are unique because their value can be eroded with just a minor scratch or damage. This all-or-nothing approach in the valuation of vintage memorabilia is dependent on their ability to stir nostalgia and other emotional responses. So, these factors can make valuing them as erratic as it is powerful.

Also, collectibles in excellent condition often have higher selling prices than those that aren’t. So, even if you have a celebrity’s photograph with their autograph, it won’t be worth much if it’s torn or scratched.

The 20-Year Cycle

There’s a longstanding idea among collectors that nostalgia runs on a 20-year cycle. Thus, some of the currently popular objects will become sought after in 20 years because people want to indulge in nostalgia. But you can’t just buy all of the trendiest items today, keep them for two decades, and sell them for thousands of dollars in the future. If this were true, everyone would be filthy rich!

An item will likely become cherished memorabilia if it meets two requirements: appeal and rarity. But with brands producing more products to fill demand without costing more, rare items are becoming harder to find. As with the case of the infamous Beanie Babies, their value plummeted when the manufacturer introduced newer product lines. Although a brand makes more money when producing more of the same product, it eats away at that item’s future value.

The item’s appeal is also another requirement that’s not easy to meet. To make money through collector’s items, you have to think several decades in advance and predict which items will become popular. Some of the things that don’t get much attention today might become a highly sought-after collectible in the future. This might be because of their rarity, or they weren’t as cherished when they were first introduced to the market.

One example of this phenomenon occurred in the 1950s and 1960s. Most wing-tipped sunglasses were made of plastic and had glass lenses, but they were only priced at a couple of dollars. They were also sold in drugstores, which means that they weren’t rare at all. Still, they’re now priced at more than a hundred dollars in most collector’s shops.

Why You Should Buy Collectibles

It’s not guaranteed that you’d make a good return on investment on a collector’s item you purchased, and not everybody has the same interests you have. It could also seem that your only motivation for buying memorabilia is to meet your interest. However, you shouldn’t avoid buying collectibles entirely.

You need to remember that people don’t invest when they buy vintage items; it’s an expense. The only way that you can sell a collectible a few years from now and overcome inflation by that time is if you’re extremely lucky.

Tips On Purchasing And Trading Collectibles

Some of these tips will help you add or even maintain the value of your treasured memorabilia:

- Don’t Throw Away Your Heirlooms

It may smell like wet socks, but you’ll never know what people will pay for a vintage item. If you’ve received an inheritance of antiques or collectibles from any of your relatives, you need to see if some things might be worth something before hiding them away in the attic. When you get a collectible for free, you can make more profits.

- Compare And Call

If you’re interested in a particular collector’s item, you need to get around and call other dealers and canvas their prices. Although most of them might say that there are already a few interested buyers, you shouldn’t make an impulse purchase. So, you need to browse the store first and call the dealer after a few hours. By doing so, you’ll think more clearly and make fewer mistakes.

If you can, you should try to buy from other collectors or even trade. You should prioritize this strategy since the price markup won’t be as huge. They’ll also likely use the same pricing guide that you do.

- Get A Written Guarantee

When you find an interesting that’s also being eyed by several collectors, ask the seller to send you a written buy-back guarantee for a period that you’ve negotiated. By doing so, the dealer can still buy it at the same price and sell it to another collector who’s very interested in the item.

The Wrap Up

You can use more reliable strategies to go against inflation. A collectible is an item that’s not very liquid and taxed, making almost no income for the near term. It could also see its value erode once you damage it. So, if you’re going to purchase a collector’s item, make sure that it will be worthwhile instead of only thinking about making money in the future.